Cultivating Humility, Not Confidence, in Ethics Training Can Keep Execs Out of Jail

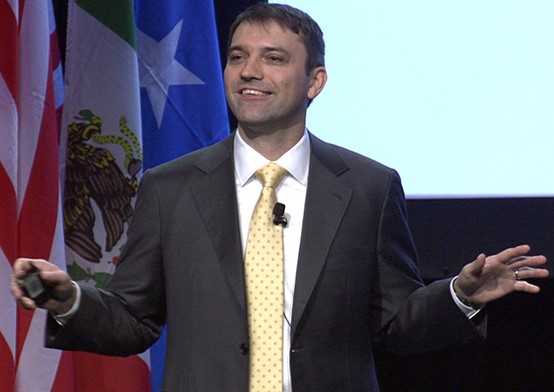

/We hear so many cases about fraudsters’ rationalizations for committing their crimes. Eugene Soltes, Harvard business professor and fraud researcher, told a story during the Tuesday morning General Session about a brilliant top executive who avoided jail not because of his sterling ethics, but because he humbled himself enough to listen to the wise counsel of a dissenting voice.

In 2002, Ben Horowitz, a prominent Silicon Valley venture capitalist, hired a talented chief financial officer who advised him to optimize stock option incentives for providing maximum benefit for its executives. Horowitz told Soltes, for Soltes’ 2016 book, “Why They Do It,” that his new CFO had reported “that her previous company’s practice of setting the stock option price at the low during the month it was granted yielded a far more favorable result for employees than ours. She also said that since it had been designed by the company’s outside legal counsel and approved by their auditors, it was fully compliant with the law.”

However, before implementing the new plan, Horowitz discussed it with his general counsel, who told him, “I’ve gone over the law six times and there’s no way this practice is strictly within the bounds of the law.”

Two years later, Horowitz’s CFO was implicated for incorrectly recording the date that she and other executives received their options during her previous job. She served nearly four months in prison for tax evasion related to the fraudulent backdating and was barred from serving as an officer of director of a public company. “The only thing that kept me out of jail,” Horowitz explained to Soltes, “was some good luck and an outstanding general counsel and the right organizational design.”

Soltes explained to the attendees that “so often in business schools, in management programs, in aisles and aisles of books, in corporate training exercises, we talk about having the right values, authenticity, a moral compass. … But what’s so powerful about [Ben’s] example is that it shows … it actually has nothing to do with that,” Soltes said.

“Ben is like everybody else. He has the same inclinations, the same limitations, the same intuition about what might be right and wrong when it actually comes to accounting finance policy.”

However, Soltes said, the difference between Ben and many other topflight executives is that he understood that he might be limited in his decision-making ability. “And so what he did was set up a routine process that any time he was about to set off on a change it would serve as a check,” Soltes said. “It would intercede prior to going down a slippery slope that might have adverse consequences for his firm and for himself. And I think this offers some powerful lessons.”

Soltes said that typical ethics training often gives executives confidence that they can now respond correctly to difficult dilemmas. “But in some instances, you might know the right thing to do but when you’re surrounded by these influences, pressures, a lack of time you might respond differently,” Soltes said.

“We need to cultivate humility not confidence. … We need to be more like Ben and say, ‘We’re limited in ways.’ We might not always see the consequences of our actions.”

Soltes said that Steven Garfinkel, former CFO of DVI told him, “What we all think is, when the big moral challenge comes, I will rise to the occasion.” But now he sees how his confidence was misplaced. Garfinkel was convicted for signing false collateral reports and double-pledging assets, and spent 26 months in prison. “There’s not actually that many of us that will actually rise to the occasion. … I didn’t realize I would be a felon,” Garfinkel said.